- Inside Mongolia

- Posts

- 🤔 Siberian Power-2: The Devil is in the Details

🤔 Siberian Power-2: The Devil is in the Details

MSE’s Latest Risers and Shifts

POWERED BY

Good morning! 🌞 Got plans for next Thursday? If not, mark your calendar for Mining Week & MinePro 2025, Mongolia’s premier event for the mining industry. ⛏️ Discover insights, meet key players, and see where the country’s mineral sector is headed!

Today’s Highlights:

📌 A Hectic Week in Mongolia

📈 MSE Launches New Basket

💡 3 Key Lessons for Mongolia’s Digital Transformation

No Time to Waste. Let’s Get Started! 🦘

MARKET

BOM: The Bank of Mongolia has included in next year’s monetary policy guidelines a review of the potential introduction of a central bank digital currency (CBDC).

MMC: Mongolian Mining Corporation (0975.HK) partners with MCS Property to support operations at Bayan Khundii mine from September 2025 to August 2028.

OT: Deirdre Lingenfelder, CEO of Oyu Tolgoi LLC, is set to step down from her position on December 9.

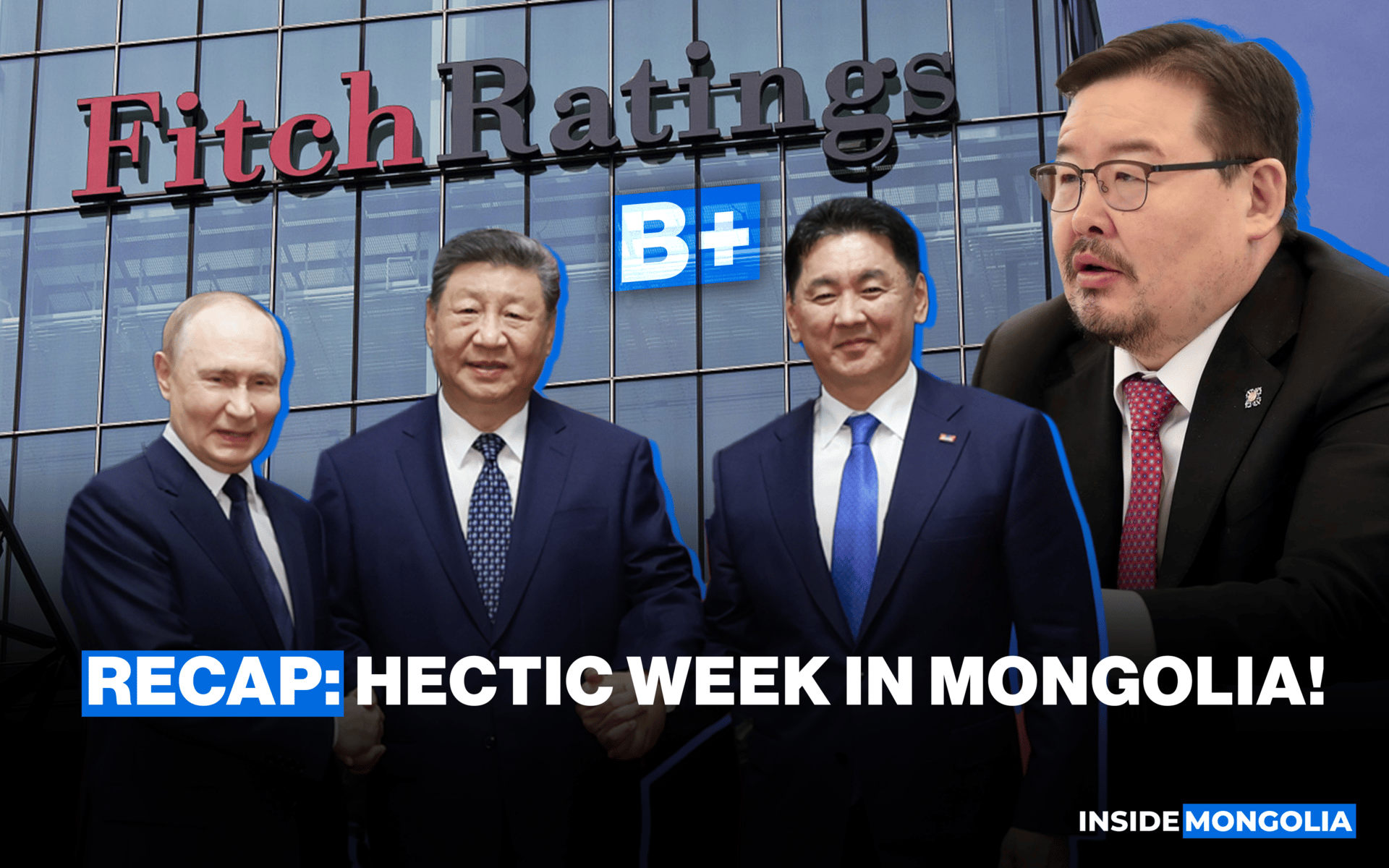

😲 Weekly Recap: A Hectic Week in Mongolia

Last week was packed with major developments in Mongolia, so here’s a roundup.

🤝 Siberian Power-2 and Ulaanbaatar Gasification

At the SCO summit, China and Russia signed binding agreements to move forward with the long-discussed Siberian Power-2 gas pipeline project. Shortly after, during the Eastern Economic Forum, Prime Minister G.Zandanshatar signed a memorandum of cooperation with Gazprom to implement a project aimed at supplying natural gas to Ulaanbaatar.

😈 The Devil is in the Details: While Russia actively promoted the deal across its media, Chinese outlets remained notably quiet. It is also worth remembering that this pipeline is primarily a strategic project to transport Russian gas through Mongolia to China, while key details such as price, timeline, and contractors remain unclear.

🤞 For Mongolia to use this gas domestically, additional infrastructure will need to be built to connect to Ulaanbaatar. The Prime Minister has pledged full support for the project.

➕ Economic Updates

From the economic side, the week’s key event was the government’s submission of the 2026 draft budget to Parliament, projecting a ₮1.4 trillion deficit, 1.2% higher than the revised 2025 plan. Over the years, budget revenues have grown on average by 15.9% annually, while expenditures have risen by 14.4%. Despite being framed by the Prime Minister as a reform-oriented budget to overcome economic challenges, it remains another deficit-driven plan.

📂 Before the submission of the 2026 budget draft, Fitch Ratings reaffirmed Mongolia’s sovereign and Development Bank ratings at B+/Stable, signaling stable investor confidence despite persistent fiscal deficits.

In short… It was an eventful week for Mongolia, with strategic agreements, fiscal updates, and credit ratings all converging. What the future holds, however, remains uncertain.

⭐ Selected for you

ECONOMY & BUSINESS

CU, a Convenience Store Operated by BGF Retail, Has Surpassed Its 500th Store in Mongolia. (MAEILBusiness)

India's Steel Giant Halts Mongolian Coking Coal Import Plan Due to Logistical Hurdles. (SXCoal)

Jade Gas Holdings Achieves Milestone with Sustained Gas Flow in Mongolia. (TR)

3 Lessons for Mongolia's Digital Transformation from Its Nomads. (WEF)

POLITICS

Russia, China & India’s Powerplay! How Mongolia Is Becoming A Crucial Link In Eurasia’s Shifting Power Equations. (EuroAsia)

Kazakhstan Seeks To Bolster Strategic Partnership With Mongolia, Tokayev Says. (MENAFIN)

Lee, the Mongolian President, Agrees to Bolster Bilateral Ties in Phone Talks. (TheKoreaHerald)

Xi Urges Russia, Mongolia to Block ‘External Interference’, Forge Deeper Economic Ties. (SCMP)

Mongolia’s Rare Earth Strategy: Balancing Risks and Rivalries. (KCSGroup)

CULTURE & LIFESTYLE

🔁 MSE’s Latest Risers and Shifts

The Mongolian Stock Exchange (MSE) has released its latest securities classification update, reshuffling listed companies across tiers to reflect their current market standing.

🗣️ Who’s Rising and Who’s Falling?

The update sees Mongol Basalt (MWB), Monlogistics Holding (MLG), and Premium Nexus (CUMN) move up from Tier II to Tier I, underlining their strengthened market positions. Conversely, Talkh Chikher (TCK), Gazar Shim Uildver (GAZR), Makh Impex (MMX), and Bodi Insurance (BODI) have been downgraded from Tier I to Tier II.

➕ Additionally, Buligaar (MBG) advances from Tier III to Tier II, while Dornod Trade (DES), Erdenes Solutions (AMT), Mongol Shiltgeen (MSH), Aduun chuluun (ADL), Neheesgui Edlel (NXE), Berkh Uul (BEU), and Frontier Land Group (MDR) move from Tier II to Tier III, reflecting varied performance across sectors.

📝 Methodology Behind the Classification

The MSE classifies companies based on 2024–2025 metrics, market capitalization, profitability, and compliance, offering investors a clear view of financial strength and growth potential. Class I companies meet these strict standards. The financial sector leads with 48% market share, while manufacturing, agriculture, and others hold 20% each, and logistics and services hold 12%, highlighting their strategic role in market infrastructure.

🤔 Market Implications

These promotions and demotions highlight shifts in financial performance and market activity. Companies like Mongol Basalt and Monlogistics Holding are emerging as market leaders, while others face challenges maintaining top-tier status. For investors, these changes provide signals for portfolio rebalancing, emerging opportunities, and areas requiring cautious monitoring in Mongolia’s capital market.

Partnership Inquiries:

Place an ad

Publisher: Ts.Ankhbayar

Writer: M.Khulan

Graphics by: Ts.Tselmeg

Disclaimer: The information Inside Mongolia provides is for educational and informational purposes only. It is not intended to be or constitute financial advice, trading advice, or any other advice. The decision whether to consider the information we provide is solely our readers' independent decision.